West University Place title loans offer quick cash using your vehicle's title as collateral, ideal for short-term needs but require careful consideration. Scrutinize hidden costs and terms to avoid financial surprises. Compare rates, understand loan conditions, and explore alternatives for a strategic approach to ensure fair deals and maintain financial health.

In the competitive financial landscape of West University Place, understanding the intricacies of title loans is paramount. This article delves into the often-overlooked realm of ‘West University Place title loans’, shedding light on both their benefits and hidden costs. We unravel complex fees, providing insights to empower borrowers. By exploring strategies to avoid unnecessary expenses, readers can make informed decisions, ensuring they navigate this financial instrument with confidence and prudence in West University Place.

- Understanding West University Place Title Loans

- Unveiling Hidden Costs and Fees

- Strategies to Avoid Unnecessary Expenses

Understanding West University Place Title Loans

West University Place title loans offer a unique financial solution for those needing emergency funding. This type of loan uses your vehicle’s title as collateral, allowing you to keep your vehicle while accessing quick funding. It’s an attractive option for West University Place residents facing unexpected expenses or seeking a fast way to secure cash.

These loans are designed for short-term financial needs and can help bridge the gap between paychecks. However, it’s crucial to understand the terms and conditions thoroughly before pledging your vehicle’s title. With careful planning and responsible borrowing, West University Place title loans can provide much-needed support during challenging times, ensuring you retain possession of your vehicle while accessing much-needed financial assistance.

Unveiling Hidden Costs and Fees

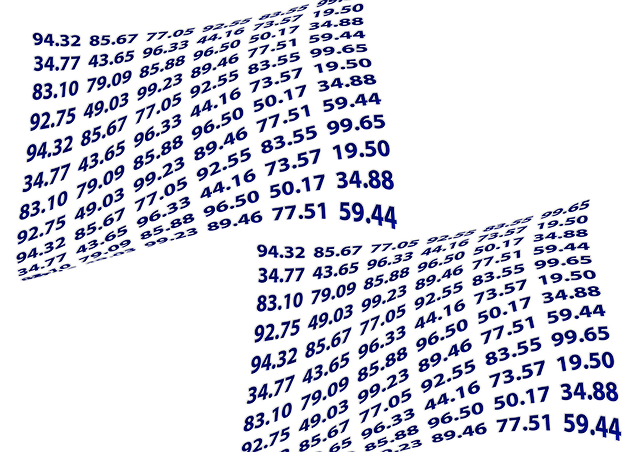

When considering West University Place title loans, it’s crucial to look beyond the advertised interest rates and terms. Unveiling hidden costs is essential for making an informed decision about this type of loan. Many lenders charge various fees that can significantly impact your overall financial burden. These may include application fees, processing charges, documentation expenses, and even early repayment penalties. Some companies might also offer additional services, such as debt consolidation or vehicle ownership maintenance, at extra costs.

Understanding these hidden expenses is vital for managing your finances effectively. West University Place title loans can provide much-needed financial assistance during emergencies, but borrowers must be aware of potential pitfalls. By carefully reviewing the terms and conditions, comparing rates across different lenders, and considering alternatives like traditional banking options or financial assistance programs, individuals can secure a loan that aligns with their needs without being caught off guard by unexpected costs.

Strategies to Avoid Unnecessary Expenses

When considering West University Place title loans, it’s essential to be strategic about avoiding unnecessary expenses. Firstly, compare interest rates across different lenders to ensure you’re getting a fair deal. Remember that higher interest can significantly add up over time. Additionally, understand the terms and conditions of the loan thoroughly before agreeing to any terms. Ask about potential fees, including administrative or processing charges, which could vary between lenders.

Another effective strategy is to explore alternatives like Title Pawn if you need quick cash. While West University Place title loans offer convenience, Title Pawn may charge lower interest rates with more flexible repayment options. Moreover, consider the impact of late payment fees and default consequences on your financial health. Proactive management of your loan, including timely payments, can help avoid these hidden costs and keep your finances in check.

When considering a West University Place title loan, it’s crucial to be aware of potential hidden costs that could significantly impact your financial situation. By understanding these fees and implementing strategies to minimize expenses, you can make an informed decision while ensuring a smoother lending experience. Stay proactive, compare offers, and choose lenders transparently to avoid unnecessary charges and take control of your financial future with West University Place title loans.