West University Place residents can access title loans using their vehicle's title as collateral, but it's crucial to understand costs, interest rates, and repossession risks. After securing a loan, prioritize effective budgeting by assessing income, expenses, and debt obligations. Focus on debt management, prioritizing high-interest debts, and consider alternatives like motorcycle title loans with shorter terms. Balance essentials, savings, and debt repayment for long-term financial stability in West University Place.

“After securing a West University Place title loan, managing your budget effectively is key to financial stability. This guide explores strategies tailored to West University Place residents, helping you navigate post-loan finances. We delve into understanding the impact of title loans on your budget and offer practical tips for short-term management. Furthermore, discover long-term financial strategies to maximize savings and minimize debt, ensuring a brighter economic future. Embrace these insights to make informed decisions with West University Place title loans.”

- Understanding West University Place Title Loans and Their Impact on Your Budget

- Strategies for Effective Budgeting After Securing a Loan

- Maximizing Savings and Minimizing Debt: Long-Term Financial Tips

Understanding West University Place Title Loans and Their Impact on Your Budget

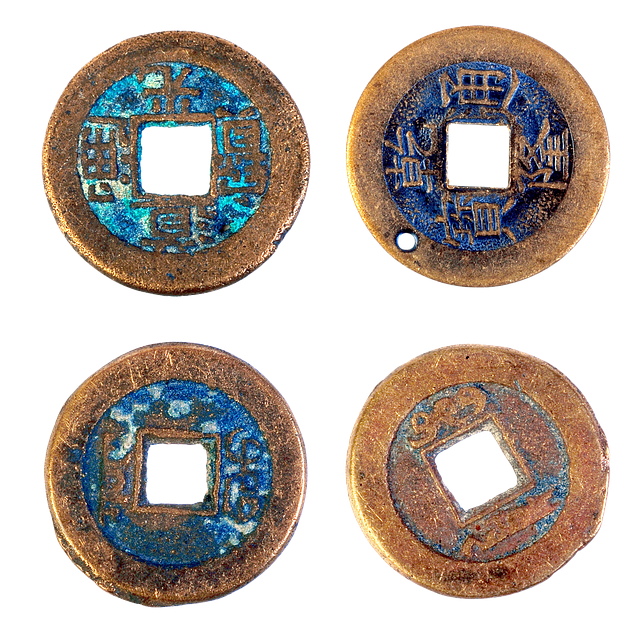

In West University Place, West University Place title loans are a financial option that allows individuals to borrow money using their vehicle’s title as collateral. These loans can be particularly appealing during times of financial urgency or when unexpected expenses arise. However, understanding how these loans work and their potential impact on your budget is crucial. The process typically involves a quick application, approval, and funding, often with flexible payment plans.

While West University Place title loans can provide much-needed cash flow, it’s essential to consider the associated costs. Interest rates vary among lenders, and the terms of repayment should be carefully evaluated. Since these loans are secured by your vehicle’s title, there’s a risk of repossession if you fail to make payments on time. Additionally, ensuring that you have a stable income and a clear understanding of your budget is vital to successfully managing these loans alongside other financial obligations, such as direct deposit or even semi truck loans, depending on your circumstances.

Strategies for Effective Budgeting After Securing a Loan

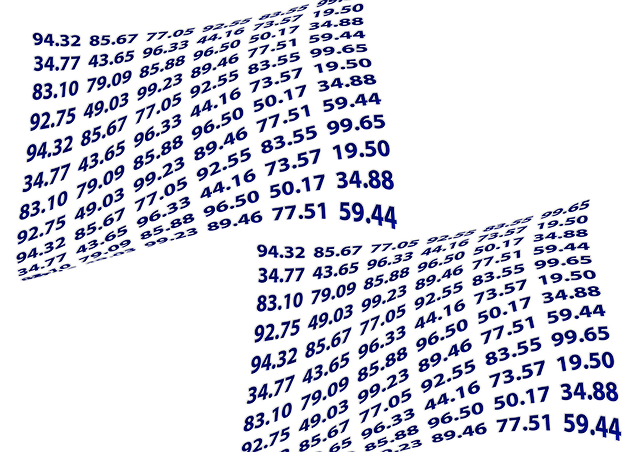

After securing a loan, such as a West University Place title loan, effective budgeting becomes your financial compass. The first step is to assess your income and expenses accurately. Start by categorizing your fixed costs like rent, utilities, insurance, and minimum debt payments. Then, track variable expenses like groceries, entertainment, and dining out.

Once you have a clear picture of where your money goes, create a budget that allocates funds for essential needs, saves for future financial goals, and includes repayment towards your loan. Consider setting up automatic payments to ensure timely repayments, take advantage of same-day funding options if needed, or explore flexible payment plans offered by lenders like Car Title Loans.

Maximizing Savings and Minimizing Debt: Long-Term Financial Tips

After securing a loan from West University Place title lenders, it’s crucial to shift your focus towards managing and reducing debt while maximizing savings for long-term financial stability. One effective strategy is to prioritize paying off high-interest debts first. This could include credit cards or personal loans with steep interest rates. By eliminating these debts, you’ll save on interest payments over time, freeing up more funds for saving and investments.

Additionally, consider alternatives like motorcycle title loans if you own a vehicle as collateral. These short-term, high-value loans can provide quick cash but come with shorter repayment periods. Understanding loan terms is essential to ensure you can comfortably repay the borrowed amount within the given timeframe. Effective budgeting involves creating a plan to allocate funds for essentials, savings, and debt repayment, balancing these elements will contribute to a healthier financial future, even when relying on West University Place title loans as a temporary solution.

Securing a West University Place title loan can provide much-needed financial support, but it’s crucial to approach it strategically. By understanding the impact on your budget and implementing effective budgeting strategies, you can manage your finances responsibly. Additionally, prioritizing long-term savings and debt minimization will contribute to your overall financial well-being. Remember, while West University Place title loans offer a solution, managing debt is an ongoing process that requires discipline and thoughtful planning.